Our Romanian accountants are able to offer our service regarding the registration for the Valued Add Tax (VAT) in Romania and other useful information about this tax. A taxpayer is considered stable for VAT on business premises, respectively where key decisions are taken on the management or exercising its functions. Also, a non-resident person is considered stable in Romania for VAT in case of a fixed establishment in Romania that has sufficient technical and human resources to perform regular deliveries of taxable goods and services.

| Quick Facts | |

|---|---|

| We offer VAT registration services | Yes |

|

Standard rate |

19% |

|

Lower rates |

5% and 9% |

| Who needs VAT registration |

Companies selling goods and services in Romania

|

|

Time frame for registration |

Around 45 days |

| VAT for real estate transactions |

5% for properties not exceeding EUR 140,000, starting with 2022

|

| Exemptions available |

For threshold below EUR 65,000

|

| Period for filing |

1 month

|

| VAT returns support | Yes |

| VAT refund | Yes |

| Local tax agent required | Yes |

Romanian VAT registration for a foreign company

According to the fiscal legislation in Romania, foreign entrepreneurs who want to establish a business in this country must register for VAT payment. This requires compliance with the formalities as in the case of local companies, among which we mention:

- There is a need for a fiscal representative to take care of Romanian VAT registration for a foreign company, whether it is from the European Union or not. In this case, you can call on the services of our specialists, who can represent you with a power of attorney.

- The authorities require a VAT registration certificate from the country of origin if the company is also incorporated in another country.

- An original and notarized extract of the company’s national Trade Register is required for Romanian VAT registration for a foreign company.

- Articles of Association are also necessary for this endeavor.

- Another important document requested by the authorities is the one in which the company’s activities and transactions subject to the Romanian tax system are mentioned.

- Once these documents have been verified and accepted, the tax authorities issue a VAT number, consisting of the country code (RO), followed by 10 digits.

So, these are some of the formalities for Romanian VAT registration for a foreign company. We mention that in the case of non-EU companies, an estimated annual turnover and a declaration of activity commencement will also be required. Do not hesitate to discuss all these aspects with one of our Romanian accountants in order to set up the registration system for paying taxes in this country.

VAT registration for a local company in Romania

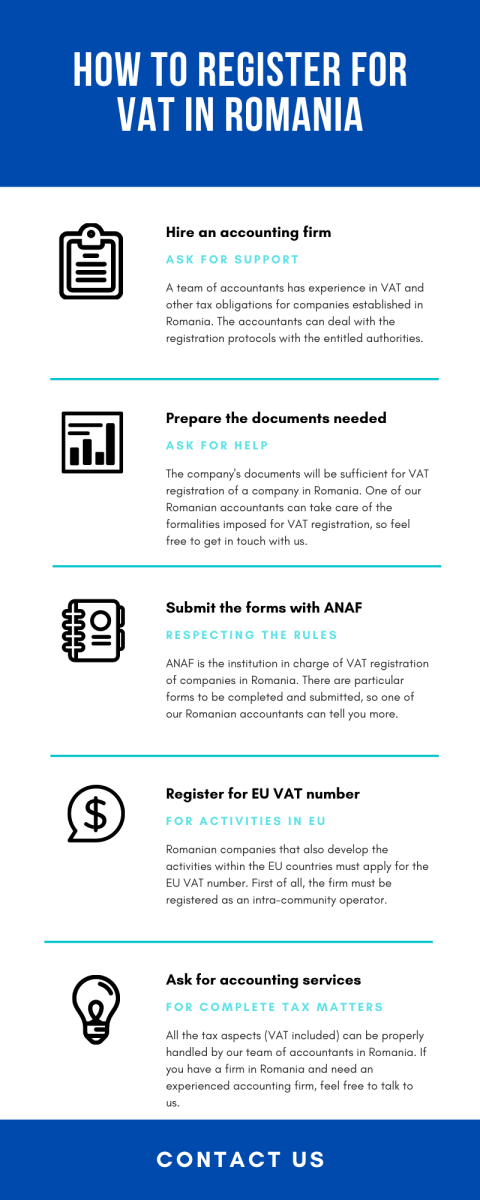

The VAT registration in Romania is not a complex procedure, however, it is best to talk to one of our accountants in Romania and receive complete information and support in this matter. The following steps can help an entrepreneur in Romania understand better the VAT registration:

- ANAF provides the registration application which needs to be submitted by the company owners.

- Forms 098 and 088 are needed for companies exceeding 300,000 lei threshold and must be submitted to the Trade Register.

- Form 099 is mandatory for VAT re-registration, as stated by the Tax Code.

- Some economic operators can use forms 010 and 088 to register for VAT at the same time when the company registration is made.

The VAT registration in Romania is not complex, but foreign entrepreneurs who do not have an idea about the applicable laws in Romania should get in touch with one of our Romanian accountants. Our experts can take care of the VAT registration process of companies in Romania, so do not hesitate to address your inquiries to our team.

Who needs to pay VAT in Romania?

Operations for VAT in Romania are those who meet the following conditions:

- represents a supply of goods/provision of services or payment of an operation assimilated;

- the place of delivery/supply is located in Romania;

- are made by taxable persons;

- are the result of economic activities.

Since January 2019, the standard VAT rate in Romania is 19% and applies to all deliveries of goods and supplies of services, including imports, for which no exemption applies (with or without credit) or one of reduced VAT rates. Reduced VAT rates remain unchanged (5% and 9%) and apply to supplies of goods/provision of services below:

– The reduced VAT rate of 9% in Romania is charged for all kinds of bread and bakery products, certain wheat types, human and veterinary medicines, books, newspapers and periodicals, accommodation in hotels or in locations with similar role, cinema tickets, entrance fees to museums, monuments, zoos, fairs and exhibitions, prosthetic and orthopedic products.

– The reduced rate of 5% applies to the delivery of housing as part of social policy, including homes for the elderly and pensioners, orphanages and rehabilitation centers and rehabilitation for children with disabilities. The reduced rate of 5% applies to the delivery of housing having a surface area exceeding 120 square meters and a value not exceeding a certain amount provided by the law. here is an infographic with extra details:

What must the VAT invoice contain?

As soon as the VAT identification code has been issued for the company, it can start its activities and issue invoices. Such a document should include the following information:

- Company name and business address in Romania.

- The unique registration code of the respective company.

- VAT code.

- Brief description of the products and/or services offered.

- The VAT category in which the respective products and/or services are included, as well as VAT rates.

- Total price without VAT.

- Total price with VAT.

- The total payment amount.

- The respective invoice number.

This type of invoice is issued with the help of dedicated programs, implemented before the start of a company’s activities. We remind you that for more information about VAT registration in Romania, you can contact our Romanian accountants.

Online sellers and VAT registration in Romania

If you have a business that takes place online in Romania, namely the sale of goods and services on the Internet, you have the obligation to register for VAT purposes. You must know in this case that a threshold of EUR 10,000 is imposed, and the registration procedures can begin with the help of a tax representative to benefit from full support in this endeavor.

If you are thinking of opening a similar business in Romania, we recommend that you contact our Romanian accountant for registration and compliance. VAT registration in Romania is not a hard process and can be completed in a maximum of 45 days.

When can you make quarterly returns?

Companies registered to pay taxes in Romania can choose monthly or quarterly Vat returns. The second option applies to companies that did not exceed a turnover of EUR 100,000 in the previous year and that did not have intra-community acquisitions of products a year ago. If you want to better understand these aspects and especially VAT registration in Romania and returns, we invite you to discuss them with our local specialists.

VAT deduction

Every taxable person in Romania shall be entitled to deduct VAT on purchases if they are designed to make taxable transactions. VAT deductible for expenses incurred for the purpose of establishing operations can be inferred retrospectively after fulfilling all the conditions of deductibility of VAT, for a period not exceeding five years. Justification tax deduction in Romania can be made based on invoices sent electronically.

Companies that own a single authorization for simplified customs procedures issued by another Member State or performing imports of goods for VAT in Romania for which they are not obliged to submit customs declarations for imports can deduct the tax due on importation of goods import declaration for VAT and excise duties. The registration of taxable persons for VAT purposes in Romania may be made by:

- Standard registration for VAT purposes to companies established in Romania;

- Special registration for VAT purposes for acquisitions (for example public institutions, insurance companies);

- Registering for VAT to taxable persons not established/established in the EU by appointing a tax representative for VAT purposes;

- Direct registration for VAT purposes only by taxable persons established in the EU.

Short facts about the applicable VAT in Romania

The standard VAT rate is set at a 19% rate for most goods and services provided in Romania, but one should know how the reduced VAT rates apply. For instance, the 9% VAT rate is applicable to varied product deliveries related to agriculture and local utility services. As for the VAT 5% rate, this applies to school supplies, entertainment events, accommodations, restaurants and catering, transportation, etc.

As for the VAT rate imposed on the import of goods, the rate is applicable in Romania to product delivery. Also, for the purchase of goods, the applicable VAT rate is the one applicable in Romania for the delivery of goods in question, in force on the date when the rate was imposed. If you would like to know more about the VAT rates applicable in Romania, feel free to address your inquiries to our team of accountants in Romania.

What is the EU VAT number?

The EU VAT number is the intra-community VAT number applicable to companies selling products and services within the EU countries. If your company is subject to this kind of trading activities, the registration for EU VAT number is mandatory, and the first step in this direction regards the registration as an intra-community operator, followed by several company documents which need to be submitted to the fiscal authorities.

Non-EU companies and VAT in Romania

Companies from non-EU countries with establishments in Romania must provide additional documents for VAT registration, and among these, a power of attorney provided by the Romanian fiscal representative for the company, the Articles of Association and the extract provided by the National Trade Register.

Can the VAT registration be canceled?

Yes, company owners interested in canceling the VAT registration may do so if they want to declare the company inactive, and if they only had a temporary activity in Romania. It is important to know that companies having problems with tax payments in Romania or a record of criminal tax offences can have the VAT registration annulled. The cancelation of the VAT registration might be subject to complex requirements, so it is best to have the assistance of our Romanian accountants in your attention. We remind that all the documents must be translated and authenticated before submission. Feel free to get in touch with one of our advisors and solicit information in this sense.

The VAT Information Exchange System

Companies registered in the European Union can share information regarding the VAT registration electronically through the VAT Information Exchange System (VIES).

The validity of VAT numbers is easier to check using this system. According to European Union provisions, VAT has to be paid whenever goods or services are acquired within the EU. The VAT has to be paid only in the EU member state of the purchaser, thus the supplier must check the purchaser’s VAT number. The VIES system offers an easy way to validate this specific number.

Our Romanian accountants can help you perform the necessary registration with the intra-community VAT Operator in Romania.

How the VIES works

The new VAT control system for the intra-community trade was introduced in 1993. This measure reduced the administrative procedures that companies were required to comply with and the number of necessary customs documents was reduced significantly.

The computerized VAT Information Exchange System was set up in order to unite all the data regarding VAT payers across international frontiers.

When trading within the EU, suppliers and purchasers must be able to check if their business partners have a valid VAT number. Suppliers of goods do not need to make VAT payments in the member state from which the goods are forwarded. Only the company that receives the goods in another member state must pay the necessary VAT for the respective goods. Therefore, companies that trade within the EU must make sure that the company receiving the goods is a taxpayer with a valid VAT number.

Our accounting experts in Romania can help you if you have a business that deals with trades in the EU.

The advantages of the VIES

The VAT Information Exchange System offers benefits both for the companies (the ones purchasing goods and the ones supplying goods) and the authorities responsible for VAT monitoring.

The VIES allows companies to quickly access a database and confirm the VAT number of their trading partners. Likewise, VAT administrators have a tool for monitoring and controlling the intra-Community trade in order to detect any kinds of irregularities.

Registration with intra-community VAT operator in Romania

The Registry of Intra-community Operators within the National Agency for Fiscal Administration exists in Romania since August 1st, 2010 and its main role is to include all traders which have activities in the EU territory.

After the registration with the intra-community VAT operator in Romania at the fiscal authority, the traders from EU can enjoy the benefits in all 28 member states. The four important rights in EU for the traders are the free movement of goods, capital, services and persons.

Thus, traders can transport goods in all the EU countries without any special customs documentation. Of course, there are some exceptions, such as exports to special EU territories or sales to international organizations, which are treated as exports.

There are some goods – such as military goods, certain drugs, alcohol and tobacco products and hydrocarbon oils – that need export licenses. From the moment of filing the request of a registration with the intra-community VAT operator in Romania, the answer will come in maximum three days.

According to the Romanian accountants, there’s no need for the following entities to make a registration with the intra-community VAT operator in Romania:

- trading entities which are not considered VAT payers, according to the Romanian Tax Code;

- trading entities having a VAT registration which has been canceled according to the Romanian Tax Code;

- trading entities with a shareholder or a director who is investigated in connection with criminal deeds related to the Romanian Tax Code.

According to the Romanian accountants, for the registration with the intra-community VAT operator in Romania, the following documents are needed:

- registration request;

- the criminal record of every shareholder (excepting the cases of joint-stock companies;

- other documents – if shareholders or administrators are the subject of criminal investigations.

You must know that traders not registered with the Romanian Registry of Intra-community Operators do not have a valid code from intra-community operations, even if they have already been registered as VAT. When requesting registration with the Registry of Intracommunity Operators, every business entity must provide the VAT registration request and the criminal record certificate, according to the Romanian accountants.

Registration with the intra-community VAT operator in Romania is necessary also for:

- non-resident taxpayers who are not established in the EU and who have the obligation to appoint a tax representative;

- non-resident taxpayers established in the EU and who have the right to be registered directly in Romania;

- non-resident taxpayers who have a business entity established outside Romania and who are established in Romania through one or several fixed establishments.

EU regulations to consider

A Romanian company may be required to register for VAT in other EU Member States in completing certain transactions (for example acquisitions of goods, possession of a stock of goods in another Member State). Any non-registered taxable persons for VAT purposes in Romania may apply for registration for import of goods and the sale or rental of property (when opted for taxation). The tax authorities may cancel registration for VAT on its own if the taxpayer is in one of the following:

- declared inactive, or entered into temporary inactivity;

- managers / associates have found certain criminal tax offenses;

- not made any statement during a calendar quarter

- in the returns submitted in one semester were not highlighted acquisitions of goods/services or delivery of goods/services.

The annual turnover for VAT registration must be in the equivalent in RON (Romanian official currency) of 65,000 euros. When calculating the turnover, the revenues from operations that are exempt without credit are also included. When a taxable body in Romania registered for VAT purposes does not exceed the exemption threshold of EUR 65,000 in a calendar year may request deregistration for VAT purposes, by using the appropriate actions provided by the law. This action may be taken between the 1st and the 10th of each month following the tax period used (month or quarter).

Investments in Romania

International investors are more than welcome in Romania, in thriving sectors like manufacturing, IT, tourism and many more. Entrepreneurs from Germany, Italy, France, Poland, and Hungary are important partners in Romania in terms of imports and exports. Below you can find facts and information about the economy and investments in Romania:

- In 2018, around EUR 47,4 billion represent the intra-community exports for Romania.

- The total FDI stock for Romania reached around EUR 81.1 billion.

- Approximately EUR 581 million were directed to the real estate sector in Romania in 2018.

- Around 24% or the total FDI flow in Romania came from investors from the Netherlands.

We are able to provide you customized advice and solutions for VAT registration in Romania. Contact us for further information and support for a wide range of financial services, including audit services in Romania.