The corporate tax in Romania is mandatory for all legal persons, with some exceptions provided by the law and you should ask for a specialized accountant advice to obtain a customized calculation for the corporate tax. In this sense, our accountants in Romania will provide all the legislative information for paying your corporate tax in optimum time and in the conditions provided by certain Romanian rules and regulations, in accordance to your company’s activity. Complete information about the corporate income tax in Romania can be provided by one of our accountants in Romania.

| Quick Facts | |

|---|---|

| Who pays corporate tax in Romania |

– local and foreign companies with permanent establishments in Romania, – non-resident companies with incomes generated in Romania |

|

Corporate tax rate |

16% |

|

CIT for gambling and nightclubs |

5% on the revenue obtained or 16% on the taxable profit |

| CIT for micro-enterprises |

For those with at least 1 employee – 1%; With no employees – 3% |

| Taxation for capital gains | 16% |

| Taxation of dividends |

No CIT under certain circumstances |

| Who qualifies for 50% payment of CIT |

Companies with activities in R&D |

| Payment of corporate tax |

Quarterly or annualy |

| Double tax treaty protection (YES/NO) | Yes |

| CIT exemptions |

– religious cults, – foundations, – public institutions, – homeowners associations, – State Treasury |

| Advance payments accepted (YES/NO) |

Yes |

| Tax exemptions for reinvested profits (YES/NO) |

Yes |

| Tax compliance and advice |

Available for company owners in Romania |

| Accounting services offered (YES/NO) |

Yes |

| Free case evaluation (YES/NO) | Yes |

| Tax year | Calendar year (January 1st – December 31st) |

|

Advance tax payments |

Companies are required to make quarterly advance tax payments based on estimated annual income. |

|

Fiscal losses |

Companies can carry forward fiscal losses declared in the annual CIT returns for up to seven years. |

| VAT rate |

– standard rate: 19% – reduced rate: 9% for food products, non-alcoholic beverages, medicines, and medical equipment; – further reduced rate: 5% for books, newspapers, magazines, etc. |

| Dividend tax exemption |

If the beneficiary holds a minimum of 10% of the shares for at least one year. |

| Tax return filing deadline |

March 25th of the year following the tax year (can be extended until June 25th for certain taxpayers). |

| Accounting standards for corporate tax in Romania |

Romanian Generally Accepted Accounting Principles (GAAP) are followed, but International Financial Reporting Standards (IFRS) are also allowed for certain entities. |

| Tax audits |

Companies may be subject to tax audits by the tax authorities to verify compliance with tax regulations. |

| Expense deductions allowed (yes/no) |

Yes, only if incurred for the purpose of generating taxable income. |

| Tax deductions | Certain expenses, such as business-related costs, employee salaries, and contributions to pension funds, are generally deductible for tax purposes. |

| Tax incentives for priority sectors |

Various tax incentives and exemptions are available for investments in specific sectors, such as manufacturing, energy, research, and development. |

| Tax identification number (TIN) |

Companies operating in Romania must obtain a tax identification number (TIN) from the tax authorities. |

| Tax administration |

The National Agency for Fiscal Administration (ANAF) is responsible for the administration and collection of taxes, i.e.; corporate tax in Romania. |

| Tax treaty network |

Romania has signed approximately 87 tax treaties with other countries to prevent double taxation and promote international trade. |

| Tax incentives for startups | Various incentives are available for startups, including reduced social security contributions, exemptions from certain taxes, and grants for innovation and development. |

What is the corporate tax rate in Romania?

In Romania, the taxable income is calculated as the difference between the income from any source and the expenses incurred in order to achieve revenue (tax deductible). This calculation is performed for each fiscal year. The taxable income is subtracted from the amount resulting, and then, the deductible expenses are added. In Romania, the corporate tax is set at 16% rate from the taxable profit obtained by a legal person in a fiscal year. The taxable income may differ from gross profit accounting, because not all expenses highlighted by a company in profit or loss are deductible, some of them being just partially deductible.

Who needs to pay the corporate tax in Romania?

Under the current law, in Romania are required to pay corporate tax the Romanian legal persons, foreign legal entities that carry out activities through a permanent establishment in Romania. Foreign legal entities and non-resident individuals who operate in Romania in an association without legal personality and foreign legal persons who derive income from or in connection with real estate located in Romania or income from the sale / disposal of shares held in a Romanian legal entity must pay the corporate tax. When individuals associated with Romanian resident legal person, for income obtained both in Romania and abroad from associations without legal personality, the individual tax due is calculated, withheld and paid by the Romanian legal entity. For taxpayers, except certain categories provided by the law, where the corporate tax is lower than the minimum tax for the portion corresponding to the total income, the corporate tax is paid at the levels mentioned below:

- For incomes that do not exceed 52,000 RON the minimum corporate tax is 2,200 RON.

- For incomes between 52,001 RON and 215,000 RON the minimum corporate tax is 4,300 RON.

- For incomes between 215,001 RON and 430,000 RON the minimum corporate tax is 6,500 RON.

- For incomes between 430,001 RON and 4,300,000 RON the minimum corporate tax is 8,600 RON.

- For incomes between 430,000,001 RON and 21,500,000 RON the minimum corporate tax is 11,000 RON.

- For incomes between 21,500,001 RON and 129,000,000 RON the minimum corporate tax is 22,000 RON.

- For incomes that exceed 129,000,001 the minimum corporate tax is 43,000 RON.

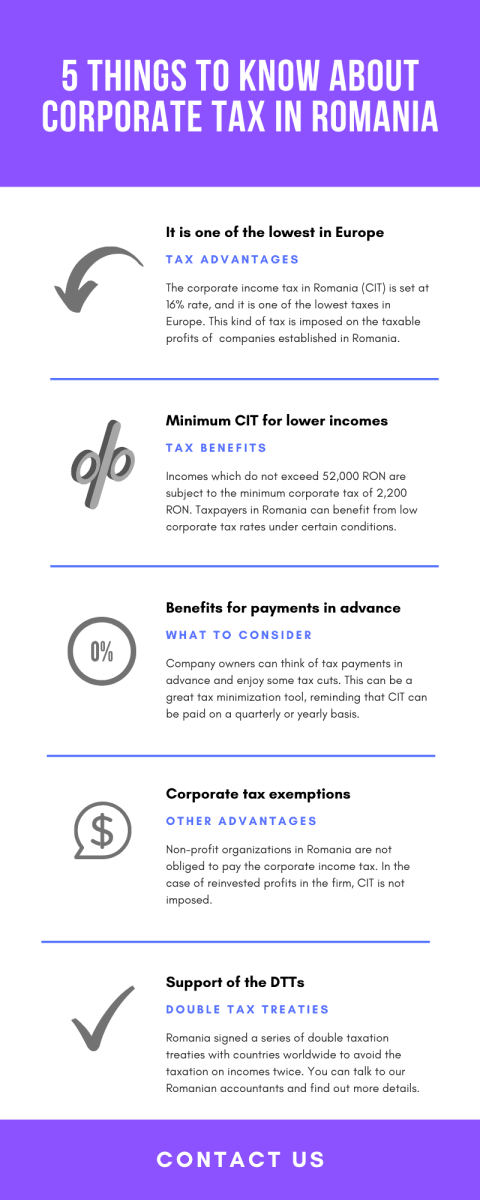

In Romania, there are certain exemptions from the corporate tax payment, for several categories of taxpayers, such as: State Treasury, public institutions, Romanian legal persons who pay income tax on microenterprises, Roman foundations formed as a result of a legacy, accredited private educational institutions, homeowners associations constituted as legal entities and residents associations recognized as owners associations, Deposit Guarantee Fund in the Banking System, Investor Compensation Fund, the National Bank of Romania, private pension guarantee fund. Here is an infographic that explains more:

You should also be aware that the compliance with the corporate tax in Romania is essential for your business and when the documentation and payments are not deposited in time, your company is liable for fees and other compulsory measures taken by the state.

Advance corporate tax payments

Each company in Romania needs to pay the corporate tax on a yearly basis, however, taxpayers can apply for paying such tax on a quarterly basis. Specific taxpayers in Romania have the possibility of paying the annual corporate income tax in advance by declaring the intention and making the payments on quarterly basis. This is also known as an anticipated quarterly advance payment and it can be calculated at a quarter of the previous annual corporate tax once the consumer price index is updated. Branches and subsidiaries of companies in Romania are obliged to apply for the quarterly advanced payments of taxes.

Tax exemptions for entities in Romania

Non-profit organizations do not need to pay the corporate income tax in Romania. Also, educational organizations, companies having agricultural activities and religious institutions do not need to pay the corporate income tax in Romania. Companies with activities in the research and development field in Romania can benefit from a deduction of 50% of the entitled costs. The deductions apply only if R&D companies have activities that align with the ones developed in the European Union.

Are there any taxes on reinvested profits?

Yes, reinvested profits in a company’s technology and equipment are exempt from corporate income tax in Romania. Numerous company owners in Romania ask for tax minimization methods and reinvest the profits in different areas in the firm. If you would like to know more about the tax minimization tools available for your business, feel free to talk to one of our accountants in Romania.

Double tax treaties signed by Romania

Romania signed a series of double taxation treaties with countries worldwide with the purpose of avoiding the double taxation on company incomes. This means that companies with establishments in Romania will pay the corporate income tax only for the revenues gained in Romania. Countries like Belarus, Austria, Georgia, Singapore, Croatia, Cyprus, Mexico, Tunisia, Thailand, Canada, Greece, Latvia, UK, Qatar, Malta, Israel, India, Germany, Bulgaria, Algeria, Kuwait, Vietnam, Luxembourg, Macedonia, Saudi Arabia, Serbia, Slovenia, Syria, Turkey, USA, Bangladesh, Estonia, Ecuador and Azerbaijan are a few of the countries that signed double taxation agreements with Romania.

Asking for an accountant in Romania

Companies in Romania need to have an accounting department by their side or can hire the services of a specialized firm in this area. Tax compliance, tax registration, and support for submitting the annual financial statements can be handled by one of our Romanian accountants who are at your disposal if you are interested in accounting matters for your business. Our team of accountants in Romania is aware of the applicable legislation that changes on a regular basis and can provide support for international companies in Romania.

FAQ about corporate tax in Romania

Legal persons, domestic and foreign legal entities with activities in Romania must observe the corporate income tax. The tax is imposed depending on the incomes registered in the country. You can discuss with our specialists and ask for extra details.

The public institutions, the State Treasury, foundations, accredited private educational institutions are not subject to the corporate income tax in Romania.

16% rate is the corporate income tax in Romania and it is considered one of the lowest in the world. Companies with establishments in Romania must observe this important tax.

Yes, owners of companies registered in Romania can choose to pay the corporate income tax quarterly or yearly, depending on the business needs. You can discuss with our accounting specialists and find out more about taxation in Romania.

No, there is no corporate income tax imposed on non-profit organizations in Romania. However, it is recommended to observe the tax rules for such institutions.

Yes, the double taxation treaties signed by Romania with countries worldwide mentions the provisions referring to the corporate income tax. One of our specialists in taxation can tell you more about this aspect.

Company owners in Romania must respect the taxation regime of this country and align with the conditions imposed. The authorities can impose severe penalties if the taxes are not paid in time. Instead of dealing with such unpleasant problems, you should hire the services of a Romanian accountant and discuss further details.

Branches and subsidiaries established in Romania need to pay the corporate income tax on a quarterly basis, as stipulated by the legislation. It is important to respect this regulation when having activities in Romania.

Companies activating in the research and development field can enjoy then 50% reduction of the corporate income tax, under certain conditions. Such companies must respect the business regulations imposed by the EU in order to have this tax advantage.

Yes, you can rely on the support of our accounting firm in Romania if you would like to register for taxation. The structure and the formalities might seem complicated to foreigners found for the first time with business in this country. Therefore, complete guidance and support throughout the entire registration process are highly recommended.

Choosing our team of accountants in Romania

Looking for business in Romania? Would you like to know more about the taxation regime in this country and the regulations imposed? You can direct your attention to our accounting services in Romania and solicit our support right away. Tax registration and compliance, tax advice, audit services, debt monitoring, risk management, tax return, preparation of annual financial statements, forensic accounting, and comprehensive financial analysis are among the accounting services you can receive for your company established in Romania. Having economic activities in Romania means respecting the tax regime and also enjoy several benefits that can be discussed with one of our specialists. We have a dedicated team of accountants with experience in this important field.

We work closely with our clients and we provide a wide range of services tailored to their needs. It is important to communicate from the start and to understand the business direction and targets. We believe that solid communication and relation will lead to excellent results on both sides. It is important to note that customers can rely on professionalism, transparency, competence, and complete support when working with our team of accountants in Romania. Instead of creating an entire accounting department and have in mind specific budget and costs, you should consider the advantages of an accounting firm in Romania. This way, you can cut the costs and benefit from complete accounting services right from the start.

Making investments in Romania

Romania is appealing to numerous international players who want to invest in this part of Europe. Sectors like tourism, IT, agriculture, farming or exploitation of natural resources are open to foreign investments of any kind, and overseas businessmen can take advantage of a reliable business sector and climate. The skilled workforce is also generous on the market and can be part of any foreign company willing to establish its operations in Romania. Being in constant development, Romania continues to attract foreign investments in a large percent, aligning with European countries in terms of doing business in a safe environment. We have gathered information and facts about the investment direction in Romania that you might find it interesting:

- in 2017, 32% of the total FDI was directed to the manufacturing sector;

- the total FDI stock for 2018 stood at approximately USD 94 billion.

- around USD 5.9 billion was the FDI inward flow for 2019 in Romania;

- Romania ranked 52nd out of 190 worldwide economies, as stated by World Bank “2019 Doing Business” report.

The support of a team of accountants in Romania will prove essential for both local and international companies in this country that must align with domestic and foreign laws, including the EU directives. If you need more information about the taxes paid by a company in Romania or you are interested in financial services, such as audit services in Romania, you may call our accountants in Romania.