Payroll in Romania is a vital part of any organization, a critical process which requires a special attention. Remuneration requires accuracy, confidentiality, a rapid processing capacity, up to date knowledge of specific legislation, in short, requires a dedicated staff, trained and continually updated with regulations applied in this domain. Our Romanian accountants are at your disposal with complete support and information regarding the payroll services your company can receive.

| Quick Facts | |

|---|---|

| Why should you outsource the payroll services in Romania? |

– cost reduction, – professional services offered by dedicated accountants in Romania, – proper fiscal control |

|

What does payroll involve? |

– salary calculation, – tax returns on salaries, – payslips, – HR solutions |

|

Types of services provided by our Romanian accountants |

– monthly payroll, – preparation of payment orders, – employee registration, – termination filings, – statistical reports, – assistance during financial controls |

| We provide support for Labour Inspectorate verifications (YES/NO) | Yes |

| Medical leave calculation (YES/NO) |

Yes |

| Management reporting and cost analysis (YES/NO) | Yes |

| Statutory reporting |

We collaborate with Romanian authorities in matters of reporting |

| HR services offered |

– preparation of work contracts, – job descriptions and policies, – full advisory and dedicated consulting services |

| Recruiting personnel (YES/NO) |

Yes |

| Personnel administration (YES/NO) | Yes |

| Preparation of declarations (YES/NO) |

Yes |

| Bank transfers related to salaries (YES/NO) |

Yes |

| We provide complete accounting services in Romania (YES/NO) |

Yes |

| Costs of payroll services in Romania |

Depends on the size of the firm and the number of employees |

| Free case evaluation for companies in Romania (YES/NO) |

Yes |

| Importance | Payroll services ensure accurate and compliant employee salaries. |

|

Local regulations |

Romanian labor laws and taxation rules impact payroll processing. |

|

Overtime and leave |

Overtime rates, sick leave, and annual leave regulations are essential. |

| Documentation | Accurate records of employee data, hours, and payments are crucial. |

| Employee benefits |

Health insurance, meal vouchers, transportation |

| Tax filings |

Employers must file monthly and annual tax and social reports. |

| Electronic reporting |

Many reports are submitted electronically to authorities. |

| Data protection |

Protecting employee data in accordance with GDPR regulations |

| Employment contracts |

Properly drafted contracts ensure clear terms of employment. |

| Termination procedures | Correct procedures for employee termination must be followed. |

| Income deductions |

Deductions for health insurance, pension funds, and more |

| Audit and review |

Regularly audit payroll records to ensure accuracy and compliance |

| Employee records |

Maintain updated records of employment history and changes |

| Currency |

Payroll calculations are typically done in Romanian Lei (RON). |

| Changing regulations | Stay informed about evolving labor and tax laws with the help of our accountants in Romania. |

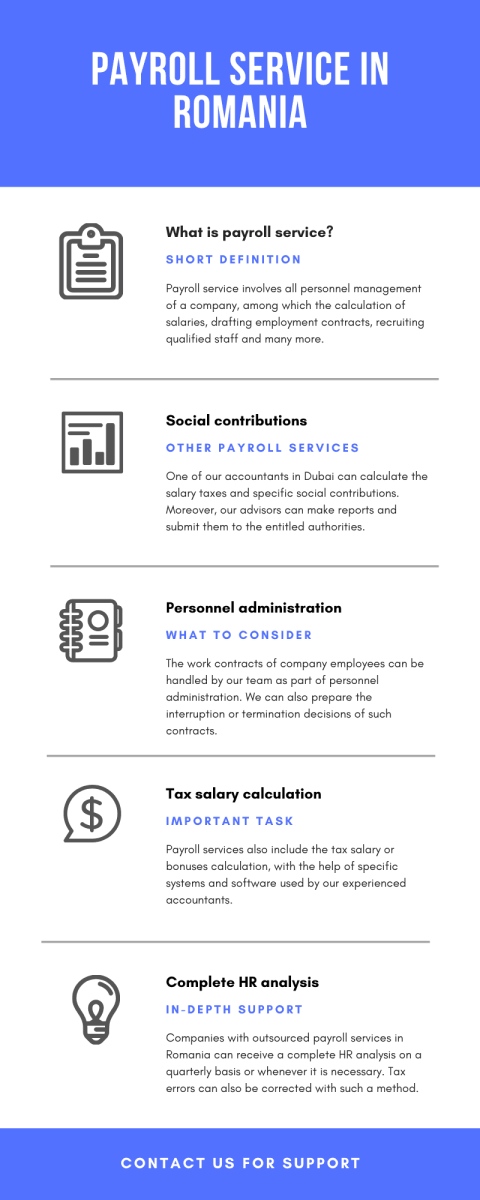

Why do I need payroll services in Romania?

By outsourcing the payroll service in Romania, the companies avoid and reduce the costs associated with personnel management (training of employees responsible for salary calculation, updating the necessary software used) and any fiscal controls ended up with sanctions. Because the applicable legislation is rapidly changing, the personnel turnover is also an issue in this sense, particularly for the accounting department or human resources department in Romania. This is a solid reason why your company should work with an external service provider which is able to fulfill successfully any task. Our team of accountants in Romania can offer details in this matter, regardless of the type of business you have in Romania. Also, we can cater to your needs regarding the audits in Romania.

Also, we invite you to watch a comprehensive video about outsourcing the payroll process:

What payroll services can I receive for my company in Romania?

Our team of advisors can provide your company with full service in the payroll filed in Romania, as follows:

- a correct analysis of the company’s departments with a functional proposal for structure and optimal and effective sizing;

- specialized support in recruiting highly qualified personnel, in agreement with the company’s requirements;

- drafting the employment contracts, the addenda amending forms of employment stipulated by the labor legislation;

- drawing forms of termination of employment contracts and the revisal submission of employment contracts, addenda and reports termination of employment;

- filling out forms for medical leave and calculating the amount and also the evidence and calculation of annual leave days;

- salary calculation, processing, and checking of data entered into the system (preparing payroll and salary slips);

- calculation of salary taxes required to be paid to the state budget and to the social security budget;

- compiling the advance payment and liquidation wage and calculation and preparation of accounting notes related to salaries.

Also, our Romanian accountants can offer complete support in tax matters and related aspects, such as:

- drawing files required by the bank for wages paid by bank transfer;

- preparing and submitting tax returns on salaries, payment orders for the contributions on salaries;

- calculation of deductions and garnishments wage, and calculation of the Global Agreement, individually or indirectly, as appropriate;

- preparation of the 112 Declaration – “Declaration on the obligation to pay social contributions, income tax and nominal record of insured persons” and its reporting to the Ministry of Finance;

- calculation of the increases and additions to base salary: overtime, bonus weekends, night allowance, heavy duty, awards, bene

We also mention that our consultants can offer legislative support on any payroll issue for your company with establishments in Romania.

What is personnel administration?

All work contracts of your employees can be controlled by our team of advisors as personnel administration. In this area, we can also prepare the suspension or termination decisions, alongside with the work certificates and annexed documents.

HR analysis for my company in Romania

Payroll services in Romania may comprise at a certain point a complete HR report based on the analysis in this field. This means that our team can analyze the social contributions involved and retained for each type of work contract. Also, any tax error can be corrected at any time. Please bear in mind that supervising the applicable legislation and its changes are vital for a company and its staff.

Employment contract in Romania

We offer you human resources services, including personnel administration by drawing up the employment contracts in Romania and their registration with the competent authorities. We are prepared to offer solutions and services for any personal issue in Romania and by choosing to work with our team you can avoid the frequent errors that are made in applying the law, which lead to unpleasant consequences such as penalties, financial losses, labor conflicts and even endless lawsuits. You will find below the most important aspects about the employment contract in Romania.

The basic rule governing a contract in Romania is generally the parties’ freedom to negotiate upon it, which means that both parties have the right to establish a term contract drawn up in what manner they want, but in accordance to the legislative provisions.

The minimum clauses that must be included in a labor contract are mentioned in the Labor Code, as provided by The Romanian Ministry of Labor, Family and Social Protection:

- The full identity of the parties

- The contract’s subject, with dual purpose – providing employment and salary

- The occupied position and the encoding provided by the Classification of Occupations in Romania

- The work place: for example the department / section of the unit headquarters / place of business and conduct of the work: either in a fixed place or in several locations

- The duration of the contract: open-ended contract or fixed-time

- The job responsibilities: as described in the job description required in the contract

- The specific risks involved

- The evaluating criteria for the work performed by the employee

- The working conditions: normal or special

- The annual leave: a minimum of 20 working days in general, a minimum of 23 days for youth under 18 years old, disabled people and people who work in difficult conditions, hazardous or harmful

- Remuneration and payment: basic salary and other bonuses, additions or additional benefits in cash or in kind, the date of payment and payment manner: in multiple installments or single tranche

- The general rights and obligations of the parties

- The rights and obligations of the parties regarding health and safety at work

- The probation period which is set up to 90 calendar days for executive positions and 120 calendar days for management positions, and a maxim of 30 calendar days for employees suffering from disability.

- The period of notice: resignation and dismissal.

The employment of foreigners in Romania is regulated by the Government Emergency Ordinance no. 56/2007.

Employment of foreigners in Romania

In Romania foreigners can be employed only if they meet the following conditions:

- vacancies cannot be filled by Romanian citizens or by citizens of other Member States of the European Union or by citizens of the Members which signed the Agreement on the European Economic Area, as well as permanent residents in Romania;

- meet specific training, work experience and licensing required by the employer according to the legislation in force;

- prove that they are medically fit in to perform that work and do not have criminal records to be incompatible with the activity carried on or will be developed in Romania;

- are included in the annual quota approved by Government Decision;

- employers have paid obligations to the state in the last quarter;

- the employer must perform the actual work for which he requested the issuance of the work permit;

- the employer has not been previously sanctioned for undeclared work and illegal employment .

Exemptions where the cumulative accomplishment is not necessary in Romania are:

- in the case of foreigners who served as administrator in a company with foreign participation in the situation where one person is appointed to this position;

- if the foreigner carries as a professional athlete, given the existence of a proof that conduct similar in another country;

- permit applicants for seasonal workers;

- for cross-border workers;

- foreigners holding a residence permit for study purposes.

Any employer who intends to have labor relations with a foreign citizen is obliged to register the individual labor contract concluded on the basis of work authorization. Foreigners cannot have overlapping functions in Romania, as the work permit gives them the right to perform work under a single contract of employment.

FAQ about payroll in Romania

In most cases, outsourcing payroll services represents an optimal solution from a financial point of point and is not limited to this. Our dedicated team of accountants in Romania can handle all employee-related matters, so feel free to send your inquiries.

Yes, this task enters our attention. If you would like to hire staff for your company, you can discuss these aspects with our specialists. The employment contracts can be drafted by our agents.

The salary calculation is an important task part of the payroll services, alongside calculation of salary taxes, bonuses, allowances, overtime, preparing salary slips, and more. One of our accountants in Romania can tell you more about these significant duties.

Employee contracts that need to be terminated or renewed can be handled by our specialists. Personnel administration is important for a company in Romania.

According to the laws in Romania that respect the international labor laws, a work contract contains information about the company, the activities of the future employee, general company rules, job responsibilities, the period of the contract, working conditions, annual leave, salary, and more.

Yes, if you open a company in Romania and intend to hire staff, it is important to register with the authorities in charge of these aspects. You can rely on the support of our payroll specialists in Romania.

Yes, besides salary calculation, a payroll specialist can prepare the bank transfers if all the approvals are obtained. If you are interested in payroll in Romania, please feel free to discuss with our specialists and find all the details you want.

Yes, if you decide on an employee to handle all the payroll tasks of your firm, this might be time-consuming. Instead, you can hire an accounting firm in Romania and ask for payroll in Romania tailored to your needs.

The costs of payroll services depend on the type of firm, the number of employees, and other aspects. A tailored offer is discussed when you get in touch with our Romanian accountants. Payroll in Romania is important.

Yes, you can ask for payroll services no matter the size of your firm in Romania. Complete accounting services for your business can be offered on request, so make sure you get in touch with our specialists.

Doing business in Romania

If you decide on business in Romania as a foreign entrepreneur we would like to highlight that you can receive full support from our team of accountants in Romania in matters of tax compliance and registration, payroll in Romania, bookkeeping, and many more. In matters of the business climate, international investors enjoy a stable and reliable environment for the proper development of their activities. Besides the encouragements and incentives offered by the Romanian government, foreigners can hire a skilled and multilingual workforce in Romania, and benefit from proper and appreciated logistics and transportation, a large domestic market, and connections to collaborators worldwide. The following facts and figures highlight a part of the economy and business direction of Romania:

- Nearly USD 97 billion was the total FDI stock for Romania in 2019.

- In terms of ease of doing business, Romania ranks 55th out of 190 worldwide economies, as revealed by the World Bank.

- The industrial sector of Romania plays a major role in the country’s GDP, the automotive field being highly appreciated on an international level.

Choosing our accountants in Romania

Are you interested in complete accounting services for your company in Romania? Would you like dedicated payroll services in Romania? You are invited to address your inquiries to our accounting firm in Romania with huge experience in this area. We work in complete professionalism, proficiency and we aim for the best possible results for our customers. Having a committed and appreciated team of specialists by your side is important for the company’s direction and development. Feel free to discuss with our specialists all you need to know about the type of services you want in your firm.

Contact us to benefit from a customized support provided by accountants for payroll in Romania, personnel administration and for audit services in Romania. If you need other services in Romania, such as paintings and interior arrangements, we can recommend our local partners.